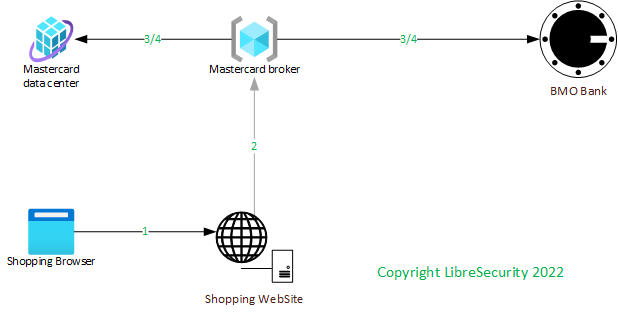

What happened

1 It’s the first time transaction of my BMO credit card(New card from BMO bank) on a sports wear website;

2 After 1 hour I have an alert phone call from BMO, my credit has a $2000 online shopping transaction is marked suspicious, BMO blocked the transaction and freeze my credit card.

What’s wrong

Scenario 1: A persistent cross site scripting(XSS) is happened on shopping website.

How:

1 When I input my credit card information and CVV code, the XSS code forward my credit card information to the attacker. Then they used my information to make a $2000 online transaction.

2 BMO bank system detected suspicious, and blocked it.

Scenario 2: An insider staff of sport wear company fraudulent used my credit information

How:

1 When my credit card information recorded by shopping website, they stored my credit card since the poorly developed online transaction code.

2 Insider fraudulent used my card information and the blocked by BMO online security system.

Deep analysis

1 Why not man-in-the-middle attack?

Online transaction is transmitted on https protocol, there is not a scenario of man-in-the-middle attack.

2 Why are only two possibilities?

It’s the first time this credit card been used.

3 How PCI-DSS regulates online transaction security?

Don’t store credit card information unless necessary, never store CVV code.

What learned

1 Online transaction should be trusted minimally.

2 Using 3rd party transaction system instead of direct input card information, such as Paypal.

3 Anymore can be hacked even you are doing prudential of your online security.